39 coupon rate formula calculator

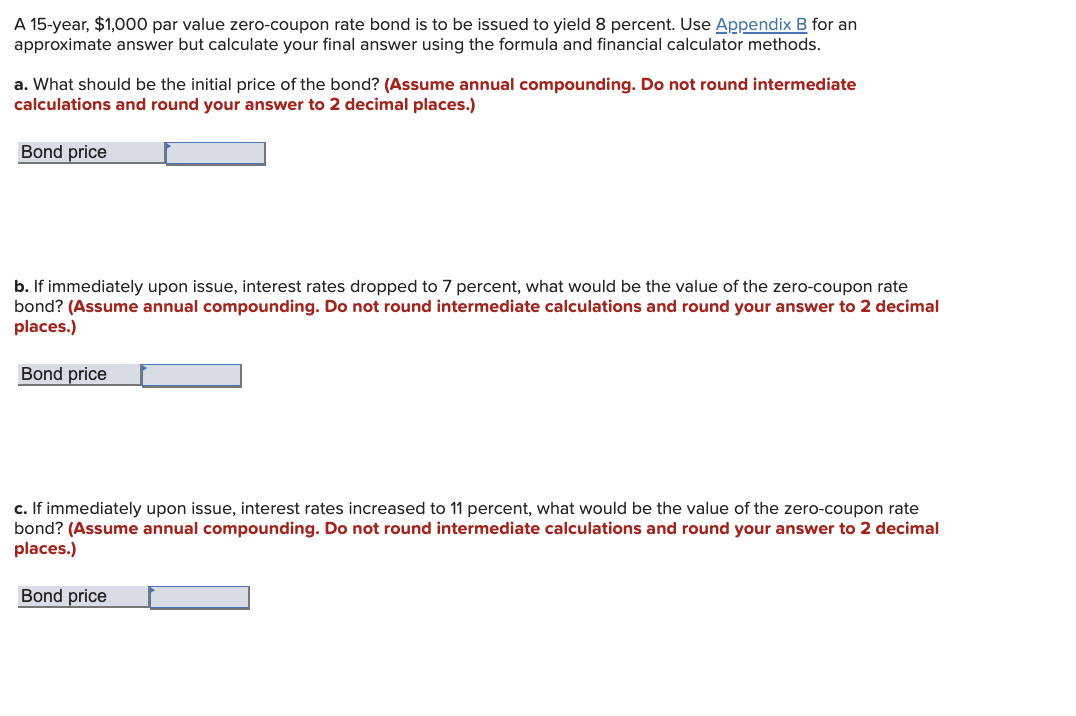

Coupon Rate Formula For Bonds - Verified Oct 2022 Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo. It is denoted by F. Step 2: Next, calculate the coupon bond formula. It is denoted F. Step 2 :Next, calculate the annual coupon rate and then calculate the periodic coupon payment of b... See more at educba.comEstimated Reading time: 4 minutesJul 8, 2019. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

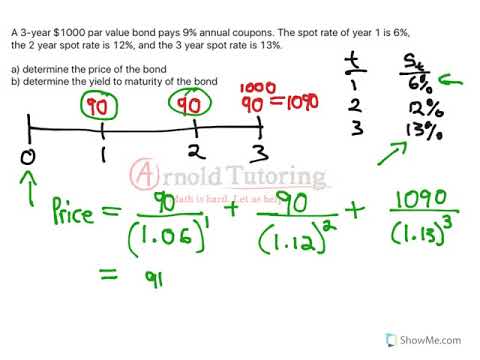

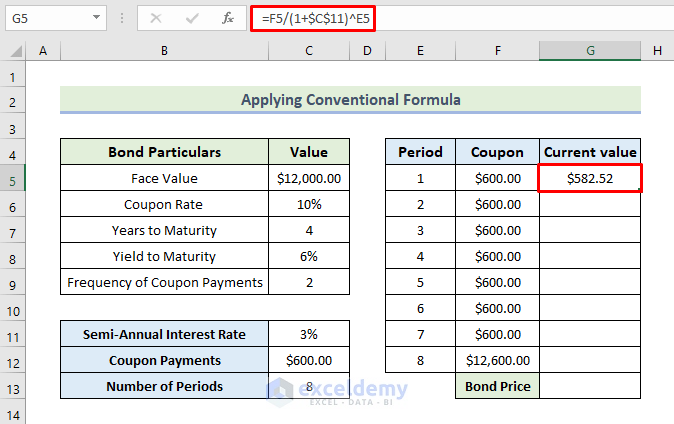

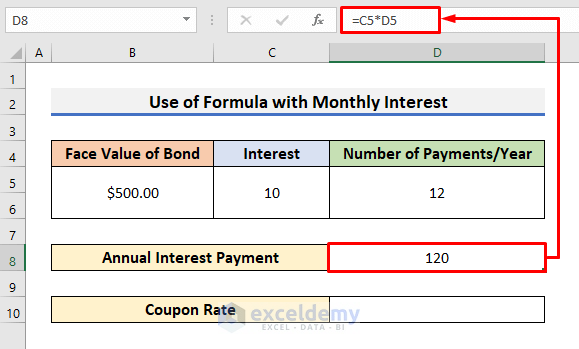

Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

Coupon rate formula calculator

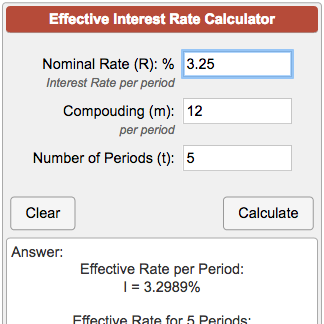

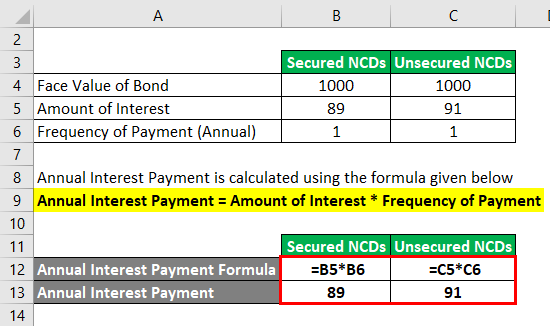

Sample Size Formula | Calculator (Excel Template) - EDUCBA And when you have a larger or smaller population, on which basis one can carry out the survey. For this, the survey is done for a set of random sample. Cochran’s formula is the most appropriate formula for finding the sample size manually. To use this formula, the desired level of precision, the population size should be known. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1% Effective Interest Rate Formula | Calculator (With Excel … Effective Interest Rate = (1 + 10%/2) 2 – 1 Effective Interest Rate = 10.25% Therefore, the effective interest rate for the quoted investment is 10.25%. Effective Interest Rate Formula– Example #2

Coupon rate formula calculator. Bond Yield to Maturity (YTM) Calculator - DQYDJ Written by: PK. On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond. This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Annualized Rate of Return Formula | Calculator - EDUCBA The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment. ... Annualized Rate of Return Formula Calculator. You can use the following Annualized Rate of Return Formula Calculator.

Coupon Rate Formula & Calculation - Study.com Convert the resulted coupon rate to percentage terms by multiplying the resulted quotient by 100. All the mentioned above steps can be summarized in the coupon rate formula that is given such... Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value Finance Calculators Active Return Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! Present Value Factor Formula | Calculator (Excel template) Now, in order to understand which of either deal is better i.e. whether Company Z should take Rs. 5000 today or Rs. 5500 after two years, we need to calculate a present value of Rs. 5500 on the current interest rate and then compare it with Rs. 5000, if the present value of Rs. 5500 is higher than Rs. 5000, then it is better for Company Z to take money after two years otherwise take …

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form. Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100. Yield to Maturity Calculator | Good Calculators CR is the coupon rate. Example 1: What is the current yield of a bond with the following characteristics: an annual coupon rate of 7%, five years until maturity, and a price of $800? Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100. CY = 8.75%, The Current Yield is 8.75% How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

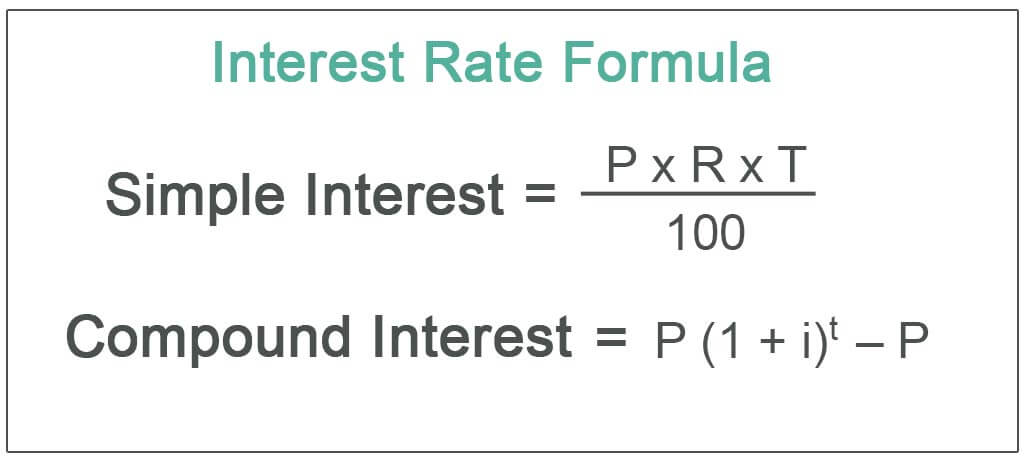

Future Value Formula And Calculator Oct 30, 2022 · The future value formula helps you calculate the future value of an investment (FV) for a series of regular deposits at a set interest rate (r) for a number of years (t). Using the formula requires that the regular payments are of the same amount each time, with the resulting value incorporating interest compounded over the term.

Average Rate of Return Formula | Calculator (Excel template) Average Rate of Return = $1,600,000 / $4,500,000; Average Rate of Return = 35.56% Explanation of Average Rate of Return Formula. The average rate of return will give us a high-level view of the profitability of the project and can help us access if …

Simple Interest Rate Formula | Calculator (Excel template) Interest on Car Loans and Other Consumer Loans is also calculated through Simple Interest Rate Formula. Certificate of Deposits (CD) is also embedded with the Simple Interest Rate feature. Bonds also pay simple interest in the form of coupon payments. Simple Interest Rate Calculator. You can use the following Simple Interest Rate Calculator

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Marginal Product Formula | Calculator (Examples with Excel Marginal Product = (17,000 – 15,000) / (8,000 – 7,200) Marginal Product = 2.5 pieces per man hour Therefore, ERT Ltd.’s marginal product is 2.5 pieces per man hour which means the addition of each unit of man hour will increase the daily production output by 2.5 pieces.

Capitalization Rate Formula | Calculator (Excel template) Capitalization Rate for property C = $20000 / $450000; Capitalization Rate for property C = 4.44% Since Capitalization Rate for property C is highest, hence the investor should invest in property C to gain maximum return out of the 3 properties that can be invested in.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Calculate The Trade Discount - Verified Nov 2022 STEP 1: Subtract each discount from 100% 100% - 5% = 95% 100% - 10% = 90% STEP 2: Multiply them together. 95% X 90% 0.95 X 0.90 = 0.855 ( Net price equivalent rate ) Net price …. Receive the latest information regarding Calculate The Trade Discount sent straightly to your personal mail.

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

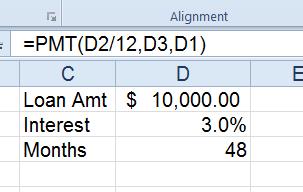

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or...

Coupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon ...

Effective Interest Rate Formula | Calculator (With Excel … Effective Interest Rate = (1 + 10%/2) 2 – 1 Effective Interest Rate = 10.25% Therefore, the effective interest rate for the quoted investment is 10.25%. Effective Interest Rate Formula– Example #2

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

Sample Size Formula | Calculator (Excel Template) - EDUCBA And when you have a larger or smaller population, on which basis one can carry out the survey. For this, the survey is done for a set of random sample. Cochran’s formula is the most appropriate formula for finding the sample size manually. To use this formula, the desired level of precision, the population size should be known.

Post a Comment for "39 coupon rate formula calculator"