45 bond price zero coupon

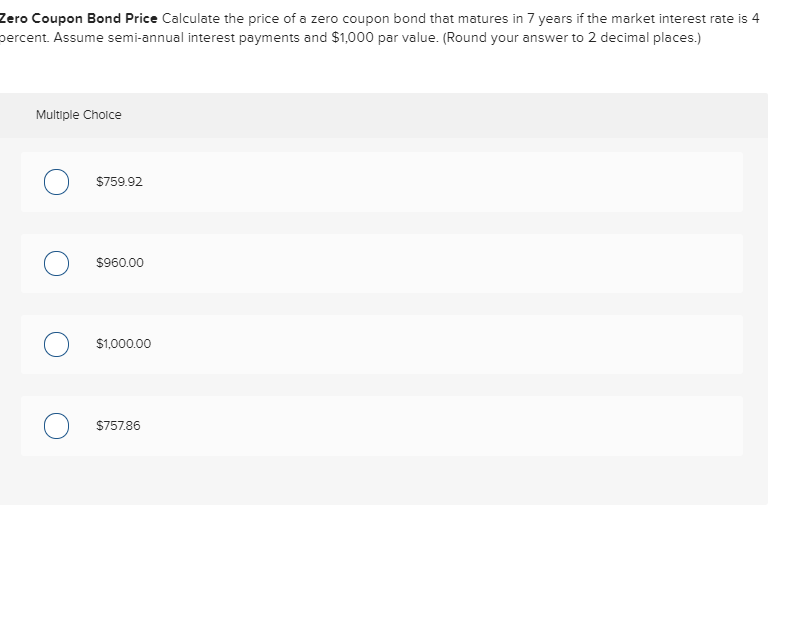

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Zero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years.

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. ... the price of a zero-coupon ...

Bond price zero coupon

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will... What is a Zero Coupon Bond? Who Should Invest? | Scripbox Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity.Hence, they trade at a deep discount. The bond pricing varies with time to maturity.. The higher the time until maturity, lower will be the price the investor will be willing to pay. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

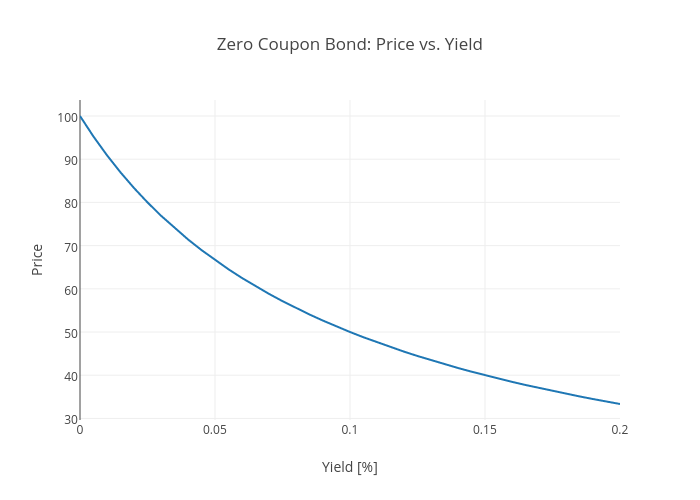

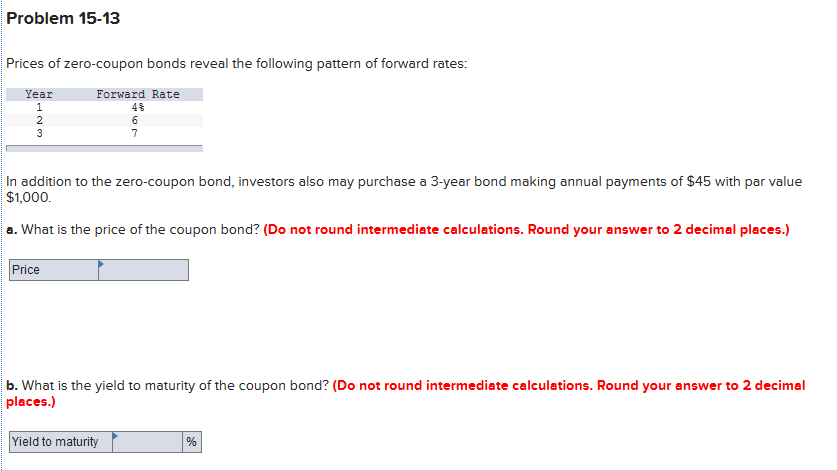

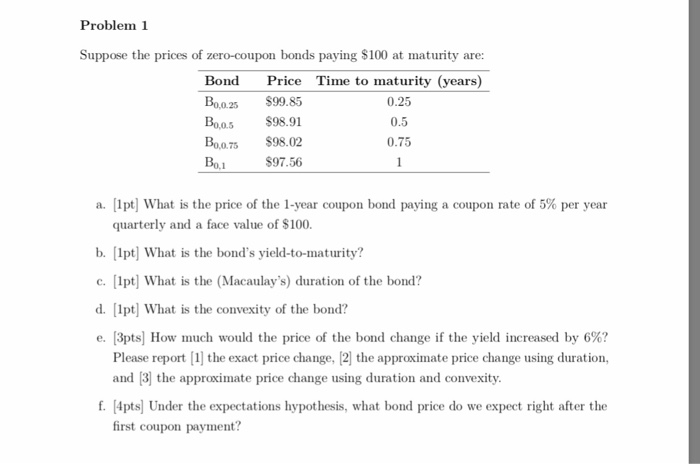

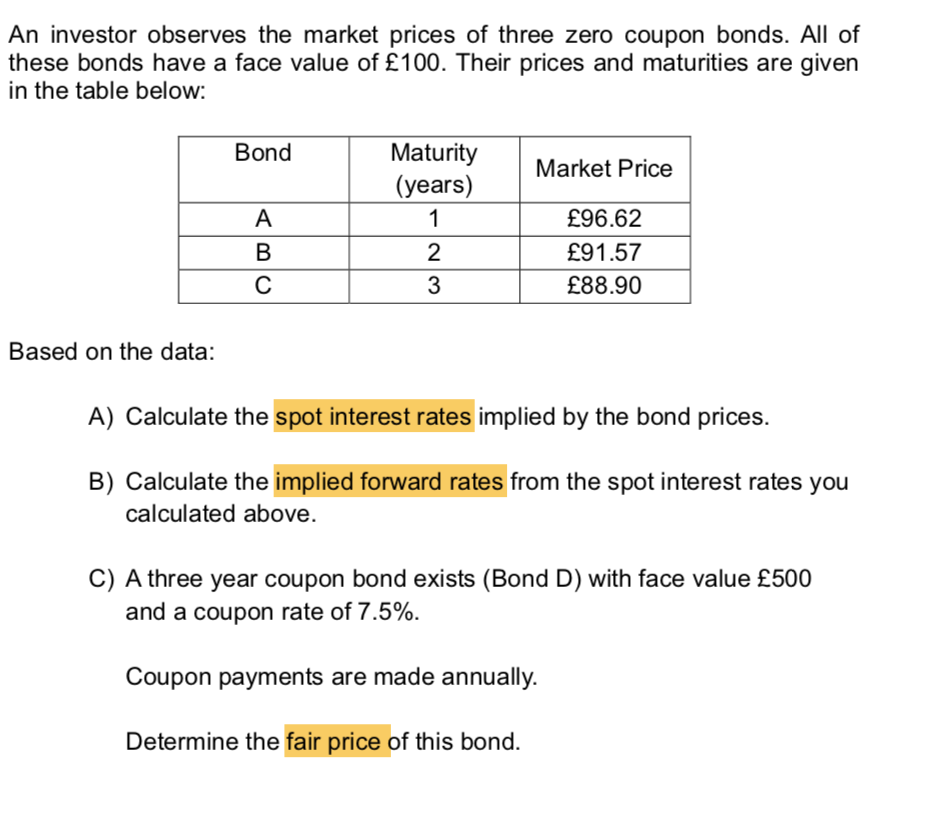

Bond price zero coupon. Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. ... This bond's price sensitivity to interest rate ... Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Are bonds sold below face value? - Sage-Answers When an investor purchases a bond, the price paid for it is called the face value. If the bond is selling for below par, its price is selling for less than its face value. As bond prices are quoted as a percentage of face value, a price below par would typically be anything less than 100. Answered: Suppose that the prices of zero-coupon… | bartleby Transcribed Image Text: Problem 15-18 Suppose that the prices of zero-coupon bonds with varlous maturitles are glven In the following table. The face value of each bond Is $1,000. TI Maturity Price (Years) 1 $ 945.66 2 855.09 3 785.92 4 718.40 5 660.24 a. Calculate the forward rate of Interest for each year.

Bond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction. What Is a Zero-Coupon Bond? Definition, Characteristics & Example Zero-Coupon Bond Price Formula. Sale Price = FV / (1 + IR) N. Where: FV is the face value of the bond. IR is the imputed interest rate (expressed as a decimal). How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 "Premium" (Trading Above Par) If Price = 100 "Par" (Trading at Par Value) If Price < 100 "Discount" (Trading Below Par)

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. What is the coupon rate on a bond that has a par value of 1000? The target purchase price of a zero coupon bond, assuming a desired yield, can be calculated using the present value (PV) formula: price = M / (1 + i)^n. M is the face value at maturity, i is the desired yield divided by 2, and n is the number of years remaining until maturity times 2. Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · The higher a bond's price is, the lower its yield will be. Here are the factors that make bond values fluctuate in the market. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed ...

Assume a \( \$ 1,000 \) face value, zero-coupon bond | Chegg.com Assume a $1, 000 face value, zero-coupon bond has 12 years remaining to maturity. The bond is currently priced to yield 4%, compounded semi-annually.What is the value of this bond? Present your answer as a whole number to two decimals (including the \$ symbol), e.g. \$987.65 (25\% marks will be deducted if the $ symbol is not provided).

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used:

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Since they are paid fully upon maturity, the price of a zero-coupon bond can be more volatile than that of a coupon bond. Upon the bond's maturity, the bondholder receives payment in an amount equivalent to the bond's face value. A corporate bond's face value is usually denoted as $1,000.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

Invest in Zero Coupon Bond at Yubi | Learn All About It So, as per the formula for calculating the bond price, the zero coupon bond might sell for Rs. 4459. When the bond matures 20 years later, the bondholder will get the full face value of the bond as a lump sum amount of Rs. 30,000 — a whopping return of Rs. 25,541 on their investment. This profit arises from the interest rate associated with ...

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity.Hence, they trade at a deep discount. The bond pricing varies with time to maturity.. The higher the time until maturity, lower will be the price the investor will be willing to pay.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will...

Post a Comment for "45 bond price zero coupon"