43 treasury bonds coupon rate

› 2016 › 10-year-treasury-bond10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 04, 2022 is 3.62%. › terms › tTreasury Bond (T-Bond) Definition - Investopedia Treasury bonds are issued with maturities that can range from 20 to 30 years. They are issued with a minimum denomination of $100, and coupon payments on the bonds are paid semiannually.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

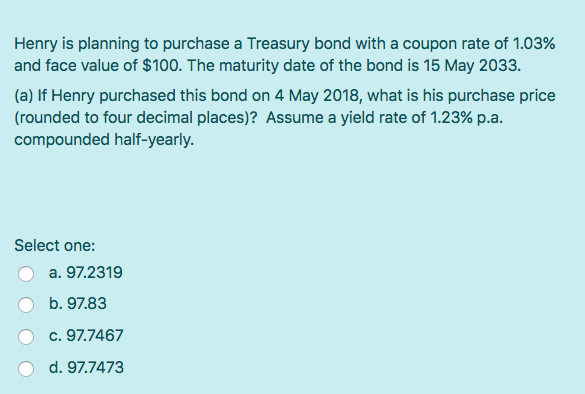

Treasury bonds coupon rate

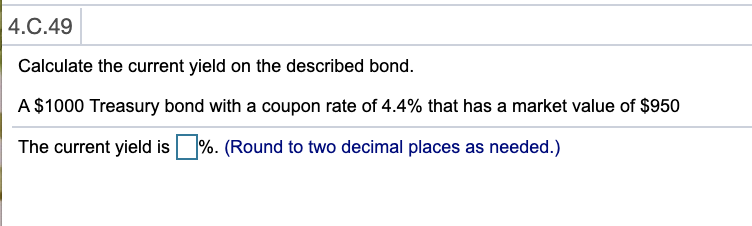

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. UK Treasury Bonds - All You Need to Know About GILTS in 2022 When you reach your coupon date, you will be given a payment that is a percentage of the bond's principal amount - this is called the coupon rate. For example, if your bond has a principal of £1,000, and you are paid an annual coupon of £50, your coupon rate would be 5%. What is the current return on government bonds? I bonds interest rates — TreasuryDirect Current Interest Rate. I Bonds. 9.62%. You can buy I bonds at that rate through May 1, 2022 to October 31, 2022 . That rate holds for the first 6 months you own the bond. It may change after that. Fixed rate. You know the fixed rate of interest that you will get for your bond when you buy the bond.

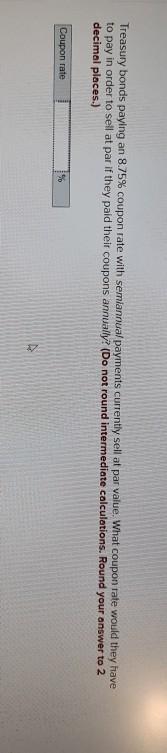

Treasury bonds coupon rate. Should You Buy Treasuries? - Forbes With interest rates rising, government bonds have become a lot more attractive for investors searching for a return on cash. The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison,... Treasury Bonds | CBK Treasury Bonds Reopening and Secondary Market Calculator Treasury Bonds Rediscounting Calculator This calculator allows you determine what your payment would be based on the bond's face value, coupon rate, quoted yield and tenor. Treasury/ Infrastructure Bonds Pricing Calculator Conventional Bonds and Bonds Re-opened on exact interest payment dates 10-Year Treasury Note Definition - Investopedia Below is a chart of the 10-year Treasury yield from March 2019 to March 2020. Over that span, the yield steadily declined with expectations that the Federal Reserve would maintain low interest... › us-treasury-bondsUS Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

How to Buy Treasury Bonds: Prices & Options for Beginners The minimum requirement for buying a Treasury is usually $100 and goes up from there in increments of $100. While a typical lot size for Treasuries is either $100,000 or $1 million, you can, of... Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ... EOF

I bonds — TreasuryDirect Tax information for EE and I savings bonds. Using savings bonds for higher education. How much does an I bond cost? Electronic I bonds: $25 minimum or any amount above that to the penny. For example, you could buy an I bond for $36.73. Paper I bonds: $50, $100, $200, $500, or $1,000. en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. Treasury. Introduced in 1997, they are currently offered in 5-year, 10-year and 30-year maturities. The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the Consumer Price Index (CPI), the ... Treasury Bonds Rates - WealthTrust Securities Limited Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 (discount). While offering higher return than other fixed income investments, T-Bond investments can be liquidated instantly by way of the secondary market. US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 15 hours ago, on 6 Oct 2022 Frequency daily Description These yield curves...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... The Treasury yield is the interest rate that the U ...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out $500...

A guide to US Treasuries Usually, the longer the maturity, the higher the interest rate, or coupon. Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. ... Treasury bonds (T-bonds): T-bonds have longer ...

Who sets the coupon rate for treasury bonds? : r/bonds - reddit The Federal Reserve sets the coupon rate as the fiscal agent for the Treasury. But there's really no "setting." Whatever is the winning yield at auction, they raise it to the next highest 8th and that becomes the coupon. So if the winning yield is 2.10, the coupon would become 2.125. 2.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

I bonds interest rates — TreasuryDirect Current Interest Rate. I Bonds. 9.62%. You can buy I bonds at that rate through May 1, 2022 to October 31, 2022 . That rate holds for the first 6 months you own the bond. It may change after that. Fixed rate. You know the fixed rate of interest that you will get for your bond when you buy the bond.

UK Treasury Bonds - All You Need to Know About GILTS in 2022 When you reach your coupon date, you will be given a payment that is a percentage of the bond's principal amount - this is called the coupon rate. For example, if your bond has a principal of £1,000, and you are paid an annual coupon of £50, your coupon rate would be 5%. What is the current return on government bonds?

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

Post a Comment for "43 treasury bonds coupon rate"