40 perpetual zero coupon bond

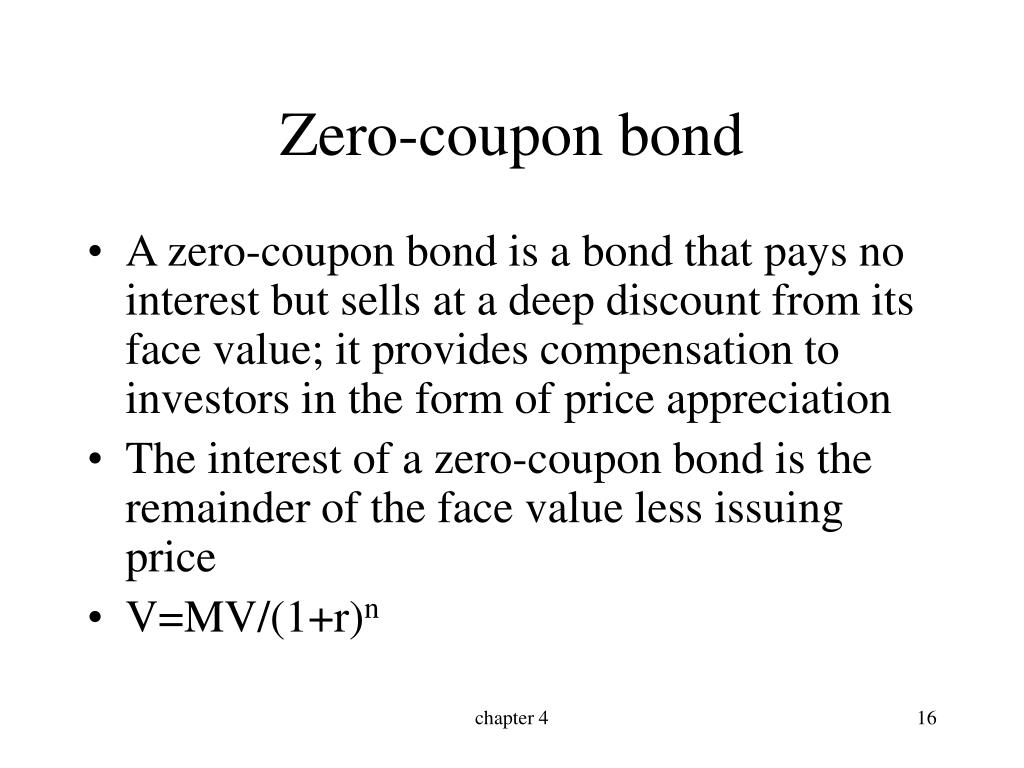

en.wikipedia.org › wiki › Perpetual_futuresPerpetual futures - Wikipedia In finance, a perpetual futures contract, also known as a perpetual swap, is an agreement to non-optionally buy or sell an asset at an unspecified point in the future. . Perpetual futures are cash-settled, and differ from regular futures in that they lack a pre-specified delivery date, and can thus be held indefinitely without the need to roll over contracts as they approach expi Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning.

de.wikipedia.org › wiki › AnleiheAnleihe – Wikipedia Zero-Perpetual: Diese Anleihe wird nie getilgt und besitzt darüber hinaus auch keinen Kupon. Der Anleger verschenkt damit faktisch den Kaufpreis. Diese Sonderform der Anleihe ist gleichzeitig Nullkuponanleihe und Ewige Rente. Zero-Perpetuals werden für Spendenaktionen genutzt.

Perpetual zero coupon bond

Price of a zero coupon bond - Finance pointers A bond that does not pay regular and periodic interest or coupon payments and pays a lumpsum amount at maturity is known as a Zero coupon bond. The lumpsum amount paid at maturity is the face value or par value of the bond. These bonds are issued at a deep discount on face value and are also known as discount bonds or deep discount bonds. Zero-coupon perpetual bonds: this April Fool is no joke The US Treasury is considering introducing zero-coupon perpetual bonds About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds (bonds that... PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP Additional features of the BOLI "zero coupon perpetual bond" are: • This bond is often purchased with as much as a 65% discount, without undue credit risk. • The maturity value is essentially guaranteed by the issuer, insurance company, without essentially any default risk. • This is all tax-free per the Internal Revenue Code!

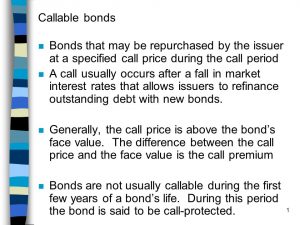

Perpetual zero coupon bond. Types of Bonds | Boundless Finance | | Course Hero Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons and the final principal payment of the bond may be traded separately. ... Perpetual FRBs are another form of FRBs that are also called irredeemable or unrated FRBs ... Impossible Finance — The Zero Coupon Perpetual Bond The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a Zero... What is the fair price of a perpetual zero-coupon bond? - Quora A zero coupon bond will always sell for a lower price than a positive coupon bond from the same issuer with the same seniority and maturity, because the positive coupon bond makes all the payments of the zero coupon bond, plus more. For example, a $1,000 face, zero-coupon five year bond pays $1,000 in five years. en.wikipedia.org › wiki › Zero-Coupon_InflationZero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.

US should issue perpetual zero-coupon bonds - Breakingviews Everything you need to empower your workflow and enhance your enterprise data management. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street... Perpetual Bonds - How Do They Work? - Accounting Hub The present value of perpetual bonds can be calculated with the present value formula of perpetuity. Present Value = D/r Where: D = annual coupon payment r= coupon rate (annual) For example, suppose a perpetual bond pays $ 50,000 in annual coupon payments and has a coupon rate of 5%. Present value = 15,000/0.05 = $ 300,000. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages So, for example, assume that you invested in a perpetual bond with a par value of $1,000 by purchasing the bond at a discounted price of $950. You receive a total of $80 per year in coupon payments. Current Yield = [80 / 950] * 100 = 0.0842 * 100 = 8.42% The current yield from the bond is 8.42%. Related Readings efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? NFP Insights | NFP BOLI - The "Zero Coupon Perpetual Bond" August 01, 2020. How is BOLI like a bond? Explore the many ways BOLI functions, its impactful features and how this knowledge can benefit your organization. Read More. About NFP; Leadership; Newsroom; Careers; Contact; NFP is a leading insurance broker and consultant providing specialized property ...

The ABCs of Zero Coupon Bonds | Hilary G. Platt, JD, CLU Zero coupon bonds are indeed debt instruments, but are issued at a discount to their face value, make no interest payments, and pay its face value at time of maturity. How Does it Work? Let's say, a hypothetical zero coupon bond is issued today at a discount price of $743 with a face value of $1,000, payable in 15 years. If you buy this bond ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha A zero-coupon perpetual bond would be revolutionary. "The hurdle to such extreme helicopter money measures is likely very high since they appear to be at odds with the spirit of Article 5 the...

open.lib.umn.edu › financialaccounting › chapter14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Explain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation. Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term “compounding.”

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years.

Bond Economics: Seriously, Money Is Not A Zero Coupon Perpetual A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice.

Helicopter Money and Zero Coupon Perpentual bonds - PGM Capital PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

Bond (finance) - Wikipedia Perpetual: no maturity Period. Coupon [ edit] The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR ).

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

› corporate-bondsCorporate Bonds India- Invest in Corporate Sector Bonds Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond , others are considered as Non-investment Grade Bond. Coupon rate : Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7%(AAA rated) to 12%(A rated) coupons in the current year 2021. On the contrary, G-secs provide 6% coupon rate.

› terms › pPerpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation.

Is fiat currency the same as a perpetual zero coupon bond? But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. Quora User

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Mr. Tee is looking to purchase a zero-coupon bond that has a face value of $50 and has 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used:

Mueslify - Zero Coupon Perpetual Crypto Bond Muesli Venture Capital Issues Zero Coupon Perpetual Crypto Bond For immediate release 16.8.2019 Muesli Venture Capital has offered Zero Coupon Perpetual Crypto Bonds to the public with fixed interest rate of 0%. The size of the bond issue is USD 10 billion. The proceeds from the issue will be

PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP Additional features of the BOLI "zero coupon perpetual bond" are: • This bond is often purchased with as much as a 65% discount, without undue credit risk. • The maturity value is essentially guaranteed by the issuer, insurance company, without essentially any default risk. • This is all tax-free per the Internal Revenue Code!

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "40 perpetual zero coupon bond"